Not known Factual Statements About Mileage Tracker

Table of ContentsMileage Tracker - TruthsMileage Tracker Things To Know Before You BuyThings about Mileage TrackerAbout Mileage TrackerMileage Tracker Things To Know Before You BuyThe Definitive Guide to Mileage Tracker

A web-based organizer ought to be able to offer you a pretty exact price quote of mileage for the journey in concern. While it might feel like a difficult task, the advantages of maintaining a vehicle gas mileage log are remarkable. As soon as you enter the behavior of tracking your mileage, it will certainly come to be 2nd nature to you.

Ready to begin your productivity journey? Inspect out our collection of notebooks!.?. !! Portage Notebooks is located in Northeast Ohio and has actually been creating professional note pads for media, regulation enforcement, and companies for over fifty years. Our notebooks are used the best quality products. If you have an interest in learning more about performance, time monitoring, or note pad organization suggestions, visit our blog. If you have any inquiries, do not think twice to connect - email us at!.

For local business owners, tracking gas mileage can be a tedious yet crucial task, specifically when it pertains to optimizing tax deductions and controlling overhead. The days of manually taping mileage in a paper log are fading, as electronic mileage logs have actually made the procedure a lot more efficient, precise, and practical.

What Does Mileage Tracker Mean?

Among one of the most significant advantages of making use of a digital gas mileage log is the time it conserves. With automation at its core, electronic devices can track your journeys without needing hands-on input for every journey you take. Digital gas mileage logs take advantage of GPS innovation to instantly track the distance took a trip, classify the journey (e.g., service or personal), and produce thorough records.

The app does all the help you. Time-saving: Save hours of manual data entrance and prevent human mistakes by automating your gas mileage logging procedure. Real-time tracking: Quickly track your miles and create reports without waiting up until the end of the week or month to log journeys. For tiny business owners, where time is cash, using an electronic mileage log can considerably streamline daily procedures and totally free up even more time to concentrate on expanding business.

Some business owners are vague concerning the benefits of tracking their driving with a mileage app. In a nutshell, tracking gas mileage throughout service travel will certainly aid to enhance your gas performance. It can also aid minimize car wear and tear.

Excitement About Mileage Tracker

This article will reveal the benefits connected with leveraging a mileage tracker. If you run a distribution business, there is a high chance of costs lengthy hours on the road daily. Service owners typically find it difficult to track the distances they cover with their automobiles given that they have a lot to consider.

In that instance, it suggests you have all the possibility to improve on that facet of your service. When you make use of a mileage tracker, you'll be able to videotape your costs better (mileage tracker).

Gas mileage monitoring plays a huge role in the lives of several vehicle drivers, workers and firm decision manufacturers. What does gas mileage tracking suggest? And what makes a mileage tracker app the finest mileage tracker application?

Rumored Buzz on Mileage Tracker

Mileage tracking, or mileage capture, is the recording of read more the miles your drive for organization. Most full time staff members or agreement employees record their mileage for repayment objectives.

It is very important to note that, while the gadget makes use of GPS and motion sensor capacities of the phone, they aren't sharing locations with employers in Visit This Link actual time - mileage tracker. This isn't a surveillance initiative, but an extra hassle-free means to catch the business trips traveled precisely. A cost-free gas mileage capture app will certainly be tough to come by

10 Simple Techniques For Mileage Tracker

Gas mileage apps for private you can find out more motorists can cost anywhere from $3 to $30 a month. We understand there are a lot of employees out there that need an app to track their gas mileage for tax and repayment functions.

There are a considerable number of advantages to utilizing a mileage tracker. For business, it's internal revenue service conformity, enhanced presence, reduced gas mileage scams, decreased management. For contractors, it's mainly about tax reduction. Let's check out these advantages even more, starting with one of one of the most vital reasons to execute a mileage tracking app: internal revenue service conformity.

Cost compensation scams make up 17% of overhead fraud. Frequently, that fraudulence is directly connected to T&E items. Lots of firms are simply uninformed of the scams due to the fact that their processes are not able to examine reports in an automated, effective style. With an automated gas mileage monitoring app, business obtain GPS-verified mileage logs from their workers.

The Basic Principles Of Mileage Tracker

Automating gas mileage monitoring enhances efficiency for those in the field and those active loading out the logs. With a gas mileage app, logs can easily be submitted for compensation and complimentary up the management job of verifying all staff member gas mileage logs.

Once more, specialists mostly use business mileage trackers to monitor their mileage for tax reductions. Some gas mileage trackers are much better than others. What makes the ideal gas mileage tracker app? Right here are a couple of manner ins which certain apps set themselves above the remainder. Automated gas mileage tracking benefits the business and its staff members in countless means.

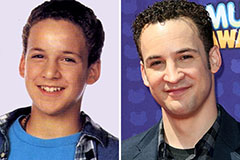

Ben Savage Then & Now!

Ben Savage Then & Now! Molly Ringwald Then & Now!

Molly Ringwald Then & Now! Andrea Barber Then & Now!

Andrea Barber Then & Now! Jurnee Smollett Then & Now!

Jurnee Smollett Then & Now! Erika Eleniak Then & Now!

Erika Eleniak Then & Now!